Author: Matt Nissley, CPA

As per Articles 17, 58, and 60 of the Afghan Income Tax Law, employers who employ two or more employees in a month are required to withhold wage tax from the payment of salaries and remit the wage withholding tax to the ARD (Afghanistan Revenue Department) within 10 days after the end of the month in which the wages were paid.

As per Articles 17, 58, and 60 of the Afghan Income Tax Law, employers who employ two or more employees in a month are required to withhold wage tax from the payment of salaries and remit the wage withholding tax to the ARD (Afghanistan Revenue Department) within 10 days after the end of the month in which the wages were paid.

The wage withholding rates are progressive rates in line with the personal income tax rates of Afghanistan (as per Article 4 of the Income Tax Law). The wage withholding rates for monthly payroll are as follows:

| Monthly Salary | Withholding Amount |

| 0 to 5,000 AFN | 0% |

| 5,000 to 12,500 AFN | 2% of the amount over 5,000 |

| 12,500 to 100,000 AFN | 150 AFN + 10% of the amount over 12,500 |

| Over 100,000 AFN | 8,900 AFN + 20% of the amount over 100,000 |

The purpose of this post is to clarify common areas of confusion based on Quest’s technical interpretation of the tax law as well as many years of experience helping taxpayers resolve these issues with the Afghanistan Revenue Department (ARD). This post assumes that the reader is already familiar with the published guidance on this issue, so please make sure that you have read the contents of Articles 17, 58, and 60 of Income Tax Manual, Taxpayer Guide 5, and Public Ruling 1384-6 as background to better understand this post.

This guide deals with salaries and wages paid to employees. It is important to first properly distinguish between employees and contractors for purposes of tax calculations. Please refer to Quest’s previous post “How to differentiate between employee and independent contractor” for more information on this topic. For a comprehensive guide to contractor tax in Afghanistan, please see here.

What Constitutes Salary And Wages?

Since employers are required to withhold tax from all salaries and wages paid to employees it is important to understand the definition of salaries and wages. Some basic definitions are provided as follows:

- From paragraph 18.8 of the Income Tax Manual: “‘Wages’ and ‘salaries’ include such items as regular pay, bonuses, overtime pay, retroactive increases, and other valuable considerations paid by the employer in money or other forms.”

- From Taxpayer Guide 5: “Salaries and wages include: regular pay for services, overtime pay, cash allowances provided by the employer to the employee (including, but not limited to, food allowances and transportation allowances), and non-cash payments for services.”

More comprehensive guidance on the definition of salaries and wages was published by the government in Public Ruling 1384-6. While an in-depth analysis of this Public Ruling is beyond the scope of this article, some key principles from this Public Ruling are summarized as follows:

- Salary and wages include all types of payments and benefits that are a reward for services provided.

- The scope of what constitutes salary and wages is broad. It is intended to include all types of remuneration without regard to its form or legal nature.

- There are two elements to the phrase “reward for services”:

- There must be a connection between a benefit and the provision of services.

- The benefit must amount to a “reward” for an employee.

Please also refer to Quest’s previous post “Which kind of benefits are part of taxable salary and wages?“

Practical Examples:

- Bonuses: All types of bonuses are subject to wage withholding tax, including performance bonuses, EID bonuses, bonuses for other special occasions, etc.

- Overtime: All overtime payments are subject to wage withholding tax.

- Allowances: All cash allowances paid are subject to wage withholding tax. Common allowances in Afghanistan include transportation allowance, phone allowance, food/lunch allowance, winter wood allowance, medical benefit allowance, etc. No matter what the allowance is for, any cash payments made by an employer to an employee are considered taxable.

- Per-Diems: The subject of per-diems is often a contentious issue because Afghanistan’s laws differ from the laws of many other countries on this issue. The tax laws of many other countries often allow per-diems to be paid free of tax to employees, up to a defined daily amount, when employees travel for work-related purposes. Afghanistan has no such provision for the tax-free payment of per-diems. Per-diems are essentially a type of cash allowance paid whereby the employer pays a daily amount to an employee for work-related travel expenses with no requirement for receipts or supporting documentation. Because such payments are a type of cash allowance, they are subject to wage withholding tax. It is worth noting that if an employer directly pays for the travel expenses of an employee (i.e. pays the vendors directly) or reimburses an employee based on receipts for actual expenses incurred, these payments are not considered taxable to the employee because the payment no longer meets the definition of an allowance. For more information on this topic, please see Quest’s previous post on per-diems here.

- Severance: Severance payments made to employees when they leave an organization are subject to tax. Some accrual-based employers accrue for severance on a monthly/annual basis, and the question then arises if wage tax should be withheld at the time of accrual or the later at the time when payment is made. As per the technical requirements of the law, wage tax needs to be withheld at the time of payment, since all withholding taxes are done on a cash-basis. However, in practice, it is also acceptable to withhold and remit wage tax at the time of recording the accrual of severance since the ARD will never complain if an entity pays tax earlier than is legally required.

Tip: If you withhold and remit wage tax on severance at the time it is paid, you may want to consider giving your employees the option of receiving their severance in monthly installments of AFN 100,000 or less to avoid the 20% tax withholding bracket. This approach can reduce the amount of tax paid on severance and maximize the net amount received by the employee. - Unused leave: If an employer pays out the balance of unused leave to an employee, that payment is subject to wage withholding tax.

- Stipends: Stipends are often paid to interns or volunteers. In some cases, this is to help cover basic costs (such as transportation to and from the office); in other cases, it may be simply to provide a basic remuneration package even if below market rate for the work being provided. Stipends are considered taxable income to the person receiving the payment and are therefore subject to wage withholding tax.

- Payment of tax on behalf of employee: If an employer pays wage withholding tax on behalf of an employee (from the employer’s funds rather than withholding from the employee), that payment of tax is itself a taxable benefit to the employee and is subject to wage withholding tax.

Tip: the complications of calculating “tax on tax” can be avoided by ensuring that base salary amounts in employment contracts are always stated in gross terms rather than net terms, with the employer always withholding tax from the employee’s gross salary amount.

Tax Calculation & Reporting Requirements

- Calculation: All taxable payments to each employee must be aggregated every month to determine the gross taxable wage of each employee. A common mistake Quest has seen is for the taxable salary of a single employee be split into two or more different components, with monthly wage tax being separately calculated on each component. Splitting an employee’s salary into multiple components for purposes of calculating tax results in an underpayment of tax, since the employee will wrongly benefit from having more than the allowed amount allocated to the lower tax brackets. Examples are as follows:

- An employee is allocated 60% to project “A” and 40% to project “B.” Each project prepares its own monthly payroll spreadsheet and tax calculation, and the relevant employee’s salary is reported 60% on one spreadsheet and 40% on the other. This will lead to an incorrect wage withholding tax calculation. That employee’s total salary should instead be aggregated on a single line in a single spreadsheet for purposes of calculating tax.

- An employer decides to pay out accrued severance to an employee before that employee has left the organization, resulting in both base salary and severance being paid in a single month. These amounts must be added together to arrive at a total gross taxable salary amount, from which wage withholding tax can be calculated.

- Withholding tables: The monthly wage tax withholding table was shown in the introduction to this post, and this withholding table is the one most frequently used since most organizations in Afghanistan pay salaries monthly. However, it is worth noting that if organizations pay salaries with a different frequency, a different withholding table must be used. Article 60 of the Income Tax Law provides withholding tables for monthly, semi-monthly, bi-weekly, weekly, and daily payment of salaries.

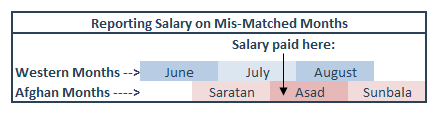

- Reporting on mis-matched months: Quest has frequently seen that some organizations use the Western month for its pay period and pays salaries at the end of the Western month even though the Afghan month is used for tax reporting.

For example, as shown in the graphic, suppose an organization pays salaries on July 25th (approximately 5th of Asad) for the month of July. Should this organization report this salary payment on the monthly tax form of Saratan or the monthly tax form of Asad? Quest has informally labeled the two approaches as follows:- The accelerated approach. With this approach, the salary for the month of July is reported on the tax form for Saratan, which means that the tax must be remitted by the 10th of Asad (roughly July 30th). This approach requires the organization to have a very quick turnaround time between the payment of salaries and the remittance of related tax. Technically this approach leads to a prepayment of tax, since the law does not require the salary to be reported in Saratan.

- The delayed approach. With this approach, the salary for the month of July is reported on the tax form for Asad, which means that the tax must be remitted by the 10th of Sunbala (roughly August 30th). This approach meets the technical requirements of the law and gives the organization much more time to file the relevant monthly wage tax return and pay the related tax.

Quest’s view is that either approach is acceptable, provided that the organization takes a consistent approach and does not switch methodologies mid-year. One benefit of using the “delayed approach” is that it usually makes it easier to reconcile total wages in the annual income tax return to the general ledger for the Afghan tax year.

- Reporting salary in the 0% bracket: The first AFN 5,000 of an employee’s monthly salary is subject to 0% withholding. Despite being subject to a 0% withholding rate, this AFN 5,000 (or less of the total salary is less than AFN 5,000) should be included on line 30 on the monthly wage withholding tax form. This approach ensures that total salary expense is reported monthly, one benefit of which is that it makes it easier to reconcile the twelve monthly wage tax forms to the annual income tax return.

- Reporting salary and tax by employee to the ARD: Technically, the monthly wage tax form has a supplementary statement on which a breakdown of salary and tax by employee can be provided. In practice, the ARD does not currently require employers to submit this monthly detail form because salary/tax by employee is not actually entered into the SIGTAS system (the government’s computerized system for tax reporting). However, the ARD will usually ask employers to provide an annual breakdown of salary and tax by employee and TIN (Taxpayer Identification Number) at the time of processing annual tax clearance.

- Annual wage statements: The law requires employers to provide each employee with an annual wage statement (a template for which is provided by the ARD), which Quest recommends doing as a best practice. However, Quest has seen that many organizations take a pragmatic approach of not providing annual wage statements by default, but instead providing wage statements upon request when such statement is needed by an employee or former employee.

- Reconciliations: Quest strongly recommends that employers perform a 3-way payroll reconciliation every month. This helps to ensure accuracy of reporting and makes it easier to prove the accuracy of wage tax withholding during at the time of subsequent tax audit. This process means reconciling the following three items to each other:

- Approved payroll sheets

- Monthly wage tax withholding tax forms

- Salary expense in the general ledger

Conclusion

Dealing with wage withholding tax can certainly be challenging, but this guide will help you deal with the most frequently encountered situations. If you have faced a challenge with wage withholding tax that is not covered in this guide, please do let us know by leaving a comment below or emailing us at team@questfinancial.af.